Companies news

80% of Small Businesses Face Unpaid Debts: How Trade Credit Insurance Can Help according to Coface

As economic pressures increase, South African SMEs are increasingly vulnerable to unpaid invoices, which can severely impact their financial health.

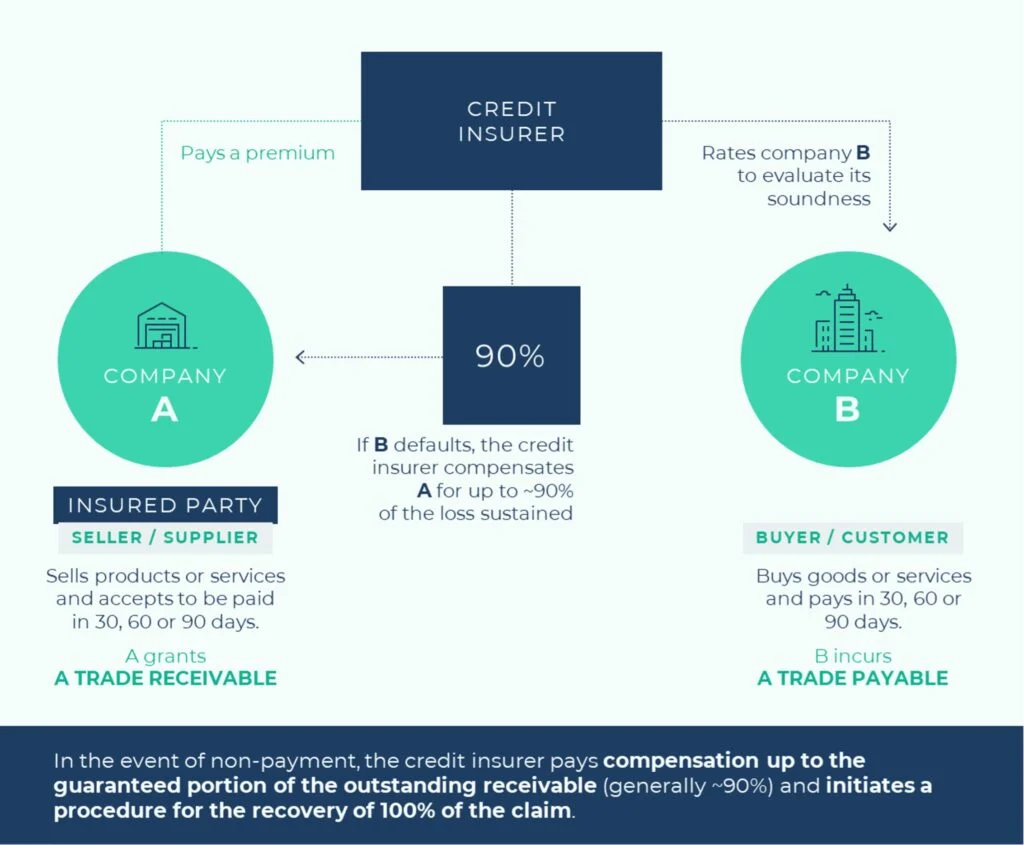

Many businesses are forced to delay payments to suppliers, creating a ripple effect that affects entire industries. To mitigate these risks, trade credit insurance (TCI) has become an essential tool for safeguarding businesses against the threat of unpaid debts.

TCI allows businesses to extend credit to customers with confidence, protecting invoices against late payments and defaults. By ensuring their sales, companies can secure their cash flow, preserve margins, and protect future growth.

How Coface Protects SMEs

Coface South Africa offers a tailored trade credit insurance solution specifically designed for SMEs. The EasyLiner product provides coverage for unpaid invoices, helping businesses manage credit risks and maintain financial stability. Key features include:

- Prevention: Get information and credit opinions on buyers to secure transactions.

- Protection: Safeguard your business from payment defaults and late payments.

- Debt Collection: Let Coface handle debt recovery, allowing you to focus on growth.

- Indemnification: Recover up to 85% of covered invoices in case of non-payment.

Roger Peixinho, Chief Commercial Officer at Coface South Africa, emphasizes that in today’s tough economic climate, managing credit risk is vital for SME survival. “EasyLiner offers essential protection, enabling SMEs to focus on growth without the worry of unpaid invoices,” he said.

Cost of Trade Credit Insurance

TCI is a strategic investment that helps businesses control their budget while protecting income. For a business with a turnover of R100 million annually, the cost of EasyLiner is approximately R120,000 per year. In case of an unpaid invoice of R250,000, EasyLiner can cover up to 85% of the amount, helping businesses recover up to R212,500.

As a member of FSACCI, Coface is dedicated to supporting South African SMEs in safeguarding their financial future through effective credit risk management.

Read more here:80% of small businesses face unpaid debts